Trading Environment in Malaysian Market

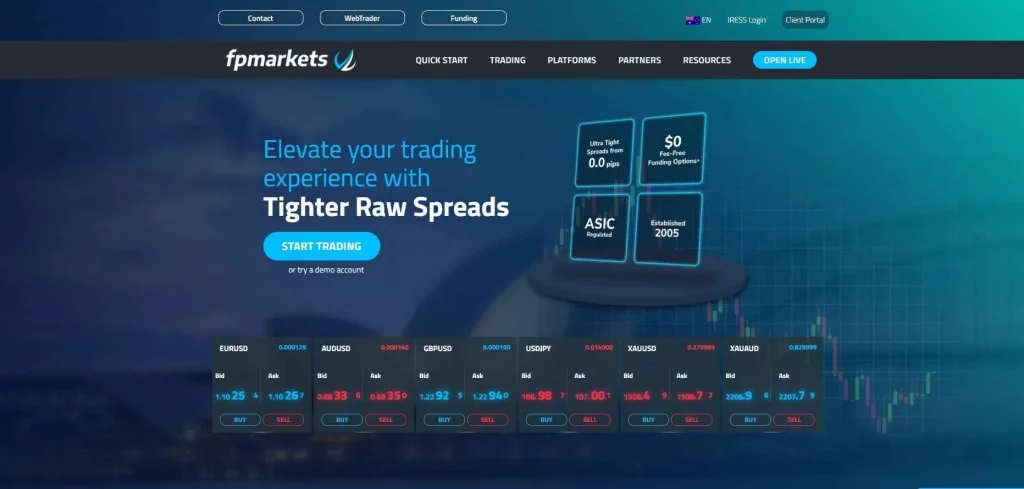

FP Markets delivers advanced trading solutions to Malaysian traders through multiple regulated entities worldwide. Malaysian clients gain access to over 10,000 tradable instruments including forex pairs, stocks, indices, commodities and cryptocurrencies. The platform offers execution speeds averaging 40 milliseconds through Equinix servers, enabling precise order placement. Trading accounts require a minimum deposit of $100 USD or equivalent in Malaysian Ringgit. The broker maintains segregated client funds in AA-rated banks, ensuring capital protection. FP Markets processes withdrawals within 1-2 business days through various payment methods available to Malaysian traders.

Account Types and Features:

- Standard Account: Spreads from 1.0 pips, zero commission

- Raw Account: Spreads from 0.0 pips, $3 commission per side

- Islamic Account: Swap-free trading with admin fees

- Professional Account: Enhanced leverage up to 1:500

- MAM/PAMM Accounts: For money managers

Trading Platforms and Technology

Malaysian traders can access markets through MetaTrader 4, MetaTrader 5, cTrader and TradingView platforms. The MT4/MT5 terminals feature 30 built-in technical indicators, 23 analytical objects, and 9 timeframes for market analysis. Automated trading capabilities support Expert Advisors and algorithmic strategies. The platforms operate in 39 languages including Malay and English. Mobile trading apps enable order placement and portfolio monitoring on Android and iOS devices.

Advanced Trading Tools

Virtual Private Server (VPS) hosting optimizes automated trading execution with servers located near major financial centers. Trade execution occurs through the Equinix NY4 facility, minimizing latency. Integration with Trading Central and Autochartist provides real-time market analysis and trading signals.

Trading Platform Specifications:

| Platform | Features | Order Types | Charts |

| MT4 | 30 Indicators | Market, Limit, Stop | 9 Timeframes |

| MT5 | 38 Indicators | 6 Order Types | 21 Timeframes |

| cTrader | Level II Pricing | Advanced Orders | Custom Indicators |

Available Markets and Instruments

The platform provides access to 72 currency pairs with major, minor and exotic combinations. Stock CFDs cover over 8,800 companies listed on exchanges including NYSE, NASDAQ and Asian markets. Commodity trading encompasses 17 metals, 5 energy products and 7 soft commodities. Cryptocurrency CFDs feature 12 major digital assets including Bitcoin and Ethereum. Index CFDs track 19 global benchmarks including the US30, SPX500 and major Asian indices.

Trading Conditions

Leverage ratios extend up to 1:500 depending on instrument category and account type. Position sizes range from 0.01 lots to 50 lots for forex pairs. Order execution occurs with no dealing desk intervention through an ECN model. Negative balance protection prevents account balances from falling below zero.

Research and Analysis Tools

FP Markets equips Malaysian traders with comprehensive market analysis resources:

Market Analysis Features:

- Daily technical and fundamental analysis reports

- Economic calendar with scheduled events

- Trading Central premium research

- Autochartist pattern recognition

- Real-time news feeds

- Market depth analysis

Account Security and Regulation

Client funds remain segregated in major Malaysian and international banks. The broker maintains licenses with multiple tier-1 regulators including ASIC and CySEC. Two-factor authentication protects account access. SSL encryption secures data transmission. Regular external audits verify operational compliance.

Payment Methods

Payment Options for Malaysian Clients:

Method | Processing Time | Fees |

Bank Transfer | 1-2 Business Days | No Fees |

Credit/Debit Cards | Instant | No Fees |

E-Wallets | Instant | Provider Fees Apply |

Educational Resources

The FP Markets Academy provides structured learning materials in multiple languages. Video tutorials cover platform navigation and trading mechanics. Live webinars address market analysis and trading strategies. Technical analysis courses explain chart patterns and indicators.

Customer Support Services

Multilingual support operates 24/7 through live chat, email and phone channels. Personal account managers assist with technical queries and account optimization. Average response times remain under 30 seconds for live chat and 2 hours for email inquiries. Support staff undergoes regular training on products and services.

Professional Trading Benefits

Qualifying professional traders access enhanced features including:

Professional Account Advantages:

- Higher leverage limits up to 1:500

- Reduced margin requirements

- Priority withdrawal processing

- Dedicated senior account manager

- Custom trading solutions

Business Metrics By Region:

Region | Active Traders | Average Volume |

Malaysia | 15,000+ | $850M Monthly |

Asia Pacific | 85,000+ | $4.2B Monthly |

Global | 200,000+ | $12B Monthly |

Risk Management Features

FP Markets provides Malaysian traders with advanced risk management capabilities through multiple order types. Stop-loss orders automatically close positions at specified price levels, limiting potential losses. Trailing stops adjust protection levels as trades move into profit. Guaranteed stop-loss orders ensure execution at the specified price regardless of market gaps or volatility. Position sizing calculators help determine appropriate trade volumes based on account equity. Risk Parameters by Account Type:| Account Type | Margin Call | Stop Out | Max Positions |

| Standard | 100% | 50% | 200 |

| Raw ECN | 100% | 30% | 500 |

| Professional | 80% | 40% | Unlimited |

Market Analysis Integration

The platform incorporates multiple third-party analysis tools to support trading decisions:- Trading Central technical analysis with 3 daily updates

- Autochartist pattern recognition scanning 48 instruments

- Economic calendar covering 500+ monthly events

- Reuters news feed with 2,000+ daily updates

- Market sentiment indicators tracking 85,000+ traders

Trading Platform Technologies

The infrastructure utilizes fiber optic connections to Equinix NY4 facility servers, delivering execution speeds averaging 40 milliseconds. MetaQuotes server architecture handles 12,000 simultaneous connections. The cTrader platform processes 10,000 quotes per second. Platform uptime exceeds 99.9% through redundant systems across multiple data centers.Mobile Trading Capabilities

Mobile applications support full trading functionality:- Real-time price streaming for 10,000+ instruments

- 30 technical indicators and drawing tools

- One-click trading from charts

- Portfolio tracking and analysis

- Push notifications for price alerts

- Biometric security authentication

FAQ:

Malaysian traders can open accounts with a minimum deposit of $100 USD or equivalent in MYR.

Yes, swap-free Islamic accounts are available with administration fees applied after holding positions beyond 5 days.

Support is provided in 18 languages including English, Malay, Chinese, and other Asian languages through 24/7 live chat, email and phone channels.